TIMIFY

TIMIFY is an appointment scheduling and resource management software for teams and enterprises

TIMIFY explores who the hybrid customer is, how their increasing dominance impacts finance and retail businesses, and how to cater for them in your business model, infrastructure and choice of support tools.

Who is the hybrid consumer?

As the name suggests, a hybrid consumer is a blend of the consumer types we have been catering to for many years.

At one end of the scale, you have consumers both young and old who, for certain products and services, prefer a physical shopping experience, complete with expert advice from staff and a hands-on experience.

At the other end of the scale, ‘digital natives’, those born into the digital era and who expect a high-quality digital experience when interacting with brands and services.

The hybrid consumer is a person who has become completely at ease with both ends of the scale, and moves seamlessly between them depending on what suits them best for a particular purchase. They may even move between online and offline channels within a single purchase journey.

The hybrid customer and its influence on financial and retail

Of course, the pandemic has driven many businesses to incorporate digital offerings and experiences to continue trading during this period, in turn creating a large new group of ‘hybrid’ consumers who are now perfectly comfortable moving between digital and non-digital interactions.

Businesses must evolve their strategy to build a customer experience that meets the needs of this increasingly dominant group of hybrid consumers in the long term, including overhauling marketing campaigns in order to reach them effectively.

As we appear to be emerging from the pandemic, physical stores are seeing a resurgence once again, though they are unlikely to return to how they were before. Bricks and mortar stores will have to incorporate and integrate the digital experience – and vice versa.

This allows consumers to easily find and utilise face-to-face interaction with your on-site experts when they need it, but perhaps use digital channels to organise and arrange that interaction without waiting in queues at your premises.

When a digital-only experience is the more convenient option, a truly hybrid customer experience should still allow options on exactly how to realise that interaction – be it a smooth online purchase, booking a video conference, attending a virtual event or getting 24-hour support through online chat.

Touchpoints across all your physical and digital spaces should make these hybrid options visible, accessible and enticing at all times.

Hybrid banking

Few industries have come to rely so heavily on a hybrid offering of digital and physical services as personal banking has in recent years.

During the pandemic, banks could no longer demand that consumers could only perform certain tasks in person at a branch, while their customers needed services, support and advice like never before.

The demands of customers have forced the banking sector to fully commit to providing innovative new digital services, for everything from verifying identity to receiving advice from a financial adviser via video conference.

While some clients will return to some in-person services as branches open up again, many will continue to demand digital innovation to provide speed, security and convenience when receiving support from one of their most crucial services.

By placing a modernised appointment booking system at the heart of their digital operations, many banks have found a way to bring trusted services and support to customers in an omnichannel format that best suits their hybrid needs.

- TIMIFY integrates convenient online appointment scheduling to every branch and online service across your business.

- Manage drop-in customers with digital queueing, giving easy access to free booking slots, while allowing customers to wait off-site.

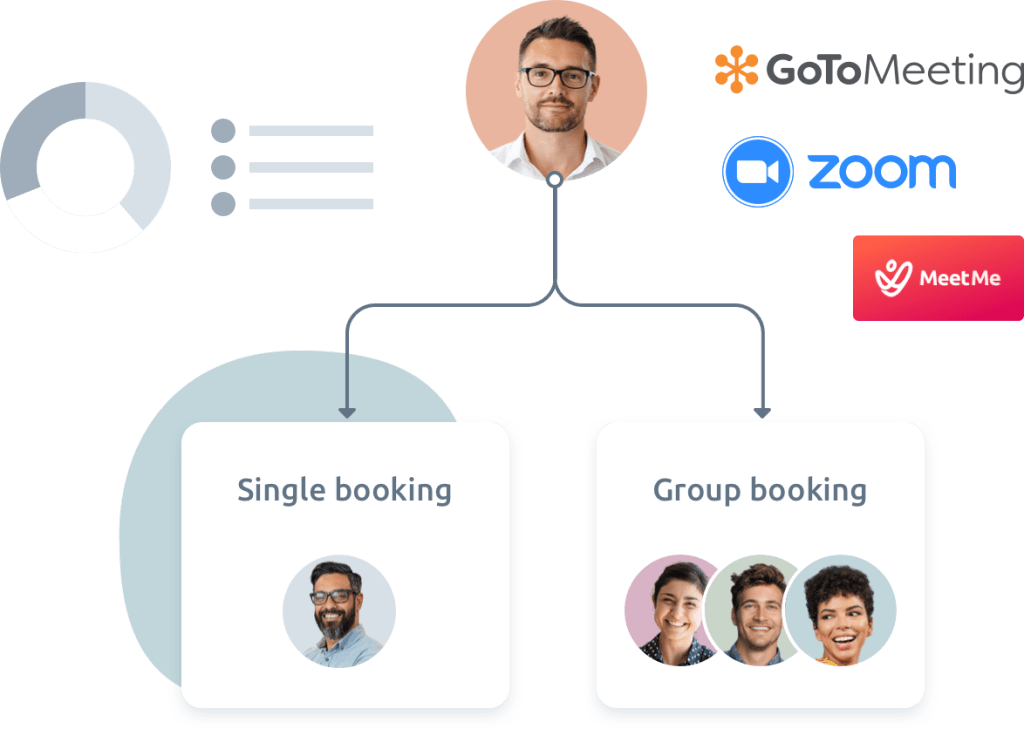

- TIMIFY integrates simple booking and delivery of appointments by video conference, taking care of every aspect from setting up the video meeting to sending reminders.

Hybrid Shopping

The hybrid retail experience provides consumers with multiple fulfilment options across various in-person and online platforms. The main aim is to maintain complete convenience and thorough communication with the client.

Whether it be booking in-store pick-ups or personalised experiences, delivering product launches or VIP events online and offline, or providing digital help and support, a well realised hybrid customer experience will suit all customer types.

Take, for example, the case of the shoe company Allbirds in the video below. They recognised during the pandemic that a hybrid customer experience means placing high importance on the development of both physical and digital store fronts, to serve all the different customer profiles they have.

This helps deliver a truly personalised experience in the modern marketplace, using the data they have on their customer based to provide and present all the relevant and desired services to customers.

- Use TIMIFY's comprehensive digital appointment booking for everything from personalised appointments and in-store pickups to managing internal meetings and even logistics such as the arrival of delivery vehicles.

- Incorporate online booking to every in-store and online touchpoint with ease.

- Use technology to build highly valuable customer profiles or receive instant customer feedback on products, services and in-store experiences.

How TIMIFY can help

The pandemic has reinforced what brands and retailers should continue to focus on: enabling their customers to shop when, how and where they want.

Your business must be equipped with resources and software that can help achieve a meaningful connection via a hybrid customer experience.

TIMIFY provides industry-leading solutions in these five core areas:

1. Make appointment booking central to all your services, whether it be booking in-store appointments or getting virtual help online

2. Optimise human and physical resource management across a business network of any size or complexity

3. Bring high-quality automation to internal workflows, massively reducing strain on your workforce, while boosting customer experience

4. Gather crucial data from every touchpoint across your business, and build a statistics engine that transforms your strategic decision-making

5. Use our Branch Management tool to control service set-up, resource management, staff schedules and performance management across any number of locations

Visit our website today to speak with our customer success team and discover how our solution can help build a truly hybrid customer experience for your business.

About the author

TIMIFY

TIMIFY is a global leader in scheduling and resource management software-as-a-service (Saas). It is known for its sophisticated, secure, and customisable enterprise-focused technology.

Related articles